By Eric Peters, CIO of One River Asset Management, which has invested over $1 billion in cryptocurrencies.

“By shining light on this, we’ll draw people’s focus,” said Marcel, my head of research. “More accurate electricity generation and consumption data will naturally come to us - you’ll see. And with clean data, industry will push for faster progress.”

His idea was sparked when I shared info from my network about a Brazilian company that pioneered private carbon-offset-credit tokenization. We were brainstorming with Sebastian, my new digital president, about how to tackle Bitcoin’s ESG concerns.

We see Bitcoin’s social and governance score as a 10 out of 10 given that its decentralized protocol is governed by a remarkable form of democracy and transfers power from usurious financial institutions to individuals.

But miners who secure the network use lots of electricity. This is by design - a feature, not a bug.

Electricity secures the global Bitcoin network. The environmental impact is material. And as with any remarkable innovation in human history, it is rightly scrutinized and held to a higher standard than archaic incumbents – that’s how progress happens.

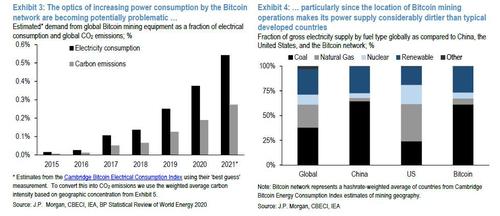

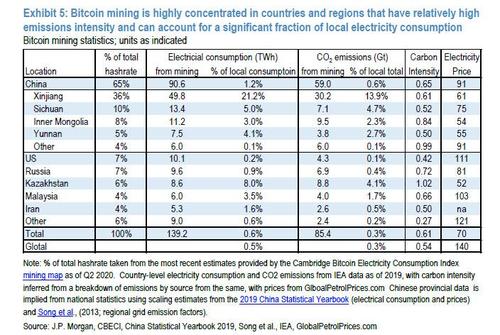

“We can already approximate the global electricity required to power the network, then through a range of geolocation estimations calculate the percentage produced by carbon-emitting generators, which allows us to calculate the carbon footprint,” explained Marcel, marching me through the math.

Bitcoin miners increasingly gravitate to the world’s lowest-cost electricity which is increasingly generated from renewables which create surpluses that can’t be stored ( e.g. hydro-electric in a rainy season, gas flaring, wind turbines at night) . The electricity they purchase supports the electrical grid, funding renewable infrastructure.

“We can conservatively estimate that 44% of the 144 terawatt-hours of annual electricity consumption that powers the network is still generated by carbon-emitting producers.”

That percentage will decline, approaching 0% as renewables gain dominance, in part funded by electricity consumed by Bitcoin miners.

“I’ve figured out how to purchase tokenized carbon-offset credits for our digital asset products, and also be the first to launch a Carbon-Neutral Bitcoin ETF – we can lead in our approach to regulation and ESG,” said Marcel. “Others will follow - that’s how we drive change.” Three months of quiet work later, we built it.

Here’s the carbon-neutral Bloomberg article: Brevan Howard-Backed Firm Plans Carbon-Neutral Bitcoin Funds